Melio Review

Melio Introduction

Melio: Simplify Your Solution for Small Business Payments

Melio review is a business-to-business (B2B) payment platform designed to simplify the way small businesses handle accounts payable and streamline their payment processes. With Melio, businesses can easily pay vendors, contractors, and suppliers, offering flexibility by allowing payments via bank transfer or credit card, even when vendors prefer checks. This focus on simplicity and flexibility makes Melio a popular choice for small to mid-sized businesses looking to optimize their cash flow without the hassle of traditional payment systems.

Limited-time offer: Save 15% on monthly plans or 25% on annual plans.

One of Melio’s standout features is its user-friendly interface. The platform is straightforward to navigate, even for those without extensive experience in finance or technology, making it ideal for busy business owners and teams. Melio also integrates seamlessly with QuickBooks and other popular accounting software, making it easier for businesses to manage financial data in one place.

Melio emphasizes security and compliance, ensuring that all transactions are encrypted and protected. With options for scheduling payments, managing approvals, and automating recurring expenses, Melio provides businesses with enhanced control over their payment operations.

Ease of Use

One of the key advantages of this payment platform is its emphasis on ease of use. Designed with small business owners in mind, Melio features an intuitive interface that allows users to navigate the platform effortlessly, regardless of their tech proficiency. The straightforward setup process requires minimal time and effort, enabling businesses to get started quickly without extensive training.

The software dashboard provides a clear overview of upcoming payments, recent transactions, and outstanding invoices, helping users manage their finances at a glance. The platform also offers guided prompts and helpful tooltips, making it easy to complete tasks such as scheduling payments or accessing payment history.

Another notable aspect of the software is its integration with QuickBooks, which streamlines bookkeeping and financial management. This integration allows users to sync data seamlessly, reducing the risk of errors and saving time on manual entries.

This combination of simplicity and efficiency makes Melio a practical choice for small businesses looking to enhance their payment processing experience.

Limited-time offer: Save 15% on monthly plans or 25% on annual plans.

Payment Methods Supported

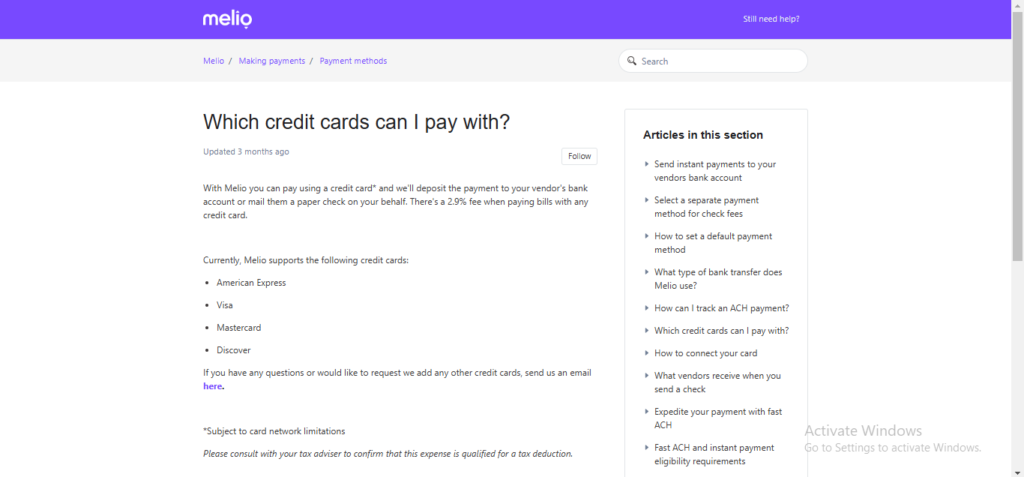

Melio offers a range of payment methods, making it easier for businesses to manage outgoing payments to vendors, contractors, and suppliers. With Melio, users can pay via bank transfer (ACH) or credit card, providing flexibility based on their cash flow needs. Notably, the solution allows businesses to use a credit card even if the vendor only accepts bank transfers or checks, giving users added convenience and financial flexibility.

Melio’s payment process is designed to be hassle-free. Users can simply add vendor details, choose their preferred payment method, and schedule or send payments in a few clicks. This variety of payment options makes the solution particularly attractive to small businesses looking to streamline their accounts payable while maximizing cash flow management.

Melio’s multiple payment methods support efficient payment workflows, allowing businesses to manage expenses smoothly without compromising convenience.

Fee Structure

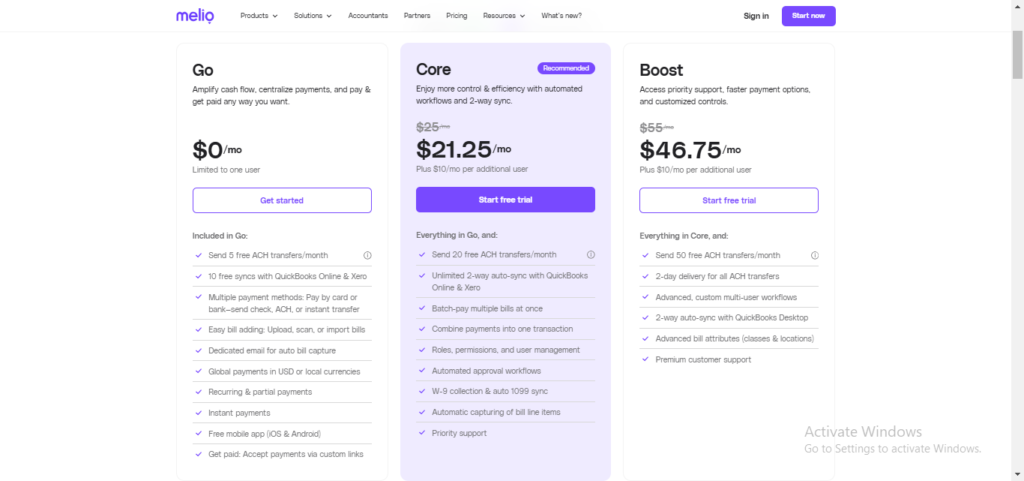

This platform provides offers a transparent fee structure that helps small businesses manage their expenses effectively. For ACH bank transfers, Melio provides a no-cost option, allowing businesses to make payments to vendors without additional fees. This is a significant advantage for companies aiming to keep costs low.

However, if businesses choose to pay vendors using a credit card, Melio charges a 2.9% processing fee. This fee applies even if the vendor only accepts bank transfers or checks, as Melio can convert the payment type. This feature provides flexibility for businesses needing to pay by credit card to manage cash flow, though it does come with an added cost.

Melio does not charge subscription fees or monthly service charges, making it a cost-effective solution for businesses that prioritize flexibility in payment options.

Melio’s straightforward fee structure, with no hidden charges, allows small businesses to use its services as needed without worrying about unexpected costs.

Integrations

Melio stands out for its seamless integrations, especially with QuickBooks, which is a key feature for many small businesses. By integrating with QuickBooks, the software allows users to sync payments, invoices, and other financial data automatically. This reduces the need for manual data entry and helps minimize errors, making it easier for businesses to maintain accurate financial records.

Beyond QuickBooks, this payment platform also integrates with popular accounting and payment platforms, making it versatile for various business setups. These integrations are designed to streamline workflows, enabling businesses to manage payments and accounts payable more efficiently within their existing systems.

Melio’s strong focus on integrations helps businesses centralize their financial operations, improving efficiency and simplifying payment processes.

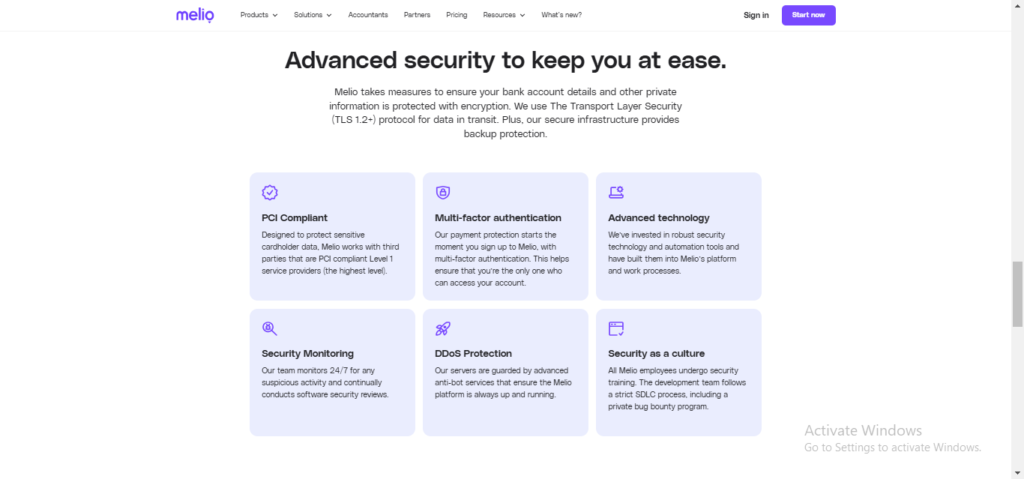

Security Features

Security is a top priority for Melio, ensuring that all transactions are conducted safely and that sensitive data is protected. the software employs bank-grade encryption to safeguard users’ financial information and prevent unauthorized access. This level of encryption is designed to keep payment data secure during transactions, offering peace of mind to businesses using the platform.

Melio also uses two-factor authentication (2FA), which adds an extra layer of security by requiring users to verify their identity before accessing the platform. This feature helps prevent unauthorized logins, ensuring that only authorized personnel can make payments or view financial data.

In addition, Melio complies with Payment Card Industry Data Security Standards (PCI DSS), which are industry-recognized standards for processing, storing, and transmitting credit card information securely. By adhering to these standards, the software demonstrates a strong commitment to protecting user data and maintaining a secure environment.

It’s Melio’s robust security measures make it a reliable payment solution for small businesses, ensuring that users’ financial information is protected at every step.

Customer Support

This platform provides provides reliable customer support to help businesses get the most out of the platform. Users have access to a comprehensive help center that offers step-by-step guides, FAQs, and articles covering a wide range of topics, from setup to troubleshooting. This resource makes it easy for users to find answers to common questions without needing direct assistance.

For more personalized support, Melio offers live chat and email support. The live chat feature connects users with support representatives in real time, allowing for quick assistance with any issues. Email support is also available, providing a convenient option for non-urgent inquiries.

Melio’s support team is known for being responsive and knowledgeable, which is especially valuable for small businesses that may not have dedicated IT support.

This platform provides accessible and efficient customer support helps ensure that users can resolve issues quickly, keeping their payment processes running smoothly.Here’s the content for the “Customer Support” section:

Pros and Cons

PROS

- The best feature I found in melio is invoicing which helps in sending invoices to your client/customer and collect payment easily.

- It is very intuitive, and the integration with QBO makes AP and AR processes efficient and automated.

- My overall experience with Melio has been a positive one. We have multiple locations and the approval process on each invoice being processed has been seamless.

- Melio is a great product that integrates easily with QuickBooks, making accounting straightforward.

CONS

- I can’t trust this group with my financials. If this is the type of service I get trying to make a payment, imagine what would happen in the case there was a mistaken withdrawal.

- What a terrible experience, no explanation as to what is going on, no one could give me any information, and I didn’t get any reply to my emails.

- Checks are lost, sent twice, logged as deposited when not.

- After just a few weeks of using it, I am having today a horrible experience: a payment of $39,000 to my vendor was not processed.